Calculate Now Your Take Home Pay Australia

Your Pay

Summary

| Component | Weekly | Fortnightly | Monthly | Annually |

|---|---|---|---|---|

| Gross Income | $0 | $0 | $0 | $0 |

| Superannuation | $0 | $0 | $0 | $0 |

| Total Tax | $0 | $0 | $0 | $0 |

| └ Income Tax | $0 | $0 | $0 | $0 |

| └ Student Loan | $0 | $0 | $0 | $0 |

| └ Medicare Levy | $0 | $0 | $0 | $0 |

| └ Medicare Levy Surcharge | $0 | $0 | $0 | $0 |

| └ Tax Offsets | $0 | $0 | $0 | $0 |

| Take Home Pay | $0 | $0 | $0 | $0 |

Pay Calculator Australia– Instantly Calculate Your Net Salary

Hello there! I’m glad you’ve stopped by. If you’re curious about how much money you actually take home after taxes, superannuation, and other deductions, our Australia Pay Calculator is here to help. As a finance expert who understands the importance of clear, simple tools, I built this calculator using the latest ATO (Australian Taxation Office) data to give you fast and accurate results with no fuss. Ready to find out what your net salary Australia looks like?

Our tool is a reliable salary calculator Australia that uses up-to-date figures from official sources. It’s designed to be user-friendly, meaning you don’t need to be a financial expert to use it. Just enter your salary details, and you’ll see exactly what comes out in your pocket at the end of the day.

How Our Pay Calculator Australia Accurately Converts Gross to Net Salary

Smart Helper for Your Salary

Our calculator takes your gross salary—what you earn before any deductions—and figures out exactly how much you’ll take home after taxes, superannuation, and other deductions.

Based on Official Guidelines

It follows the latest rules from the Australian Taxation Office (ATO), ensuring it applies the correct tax rates, accounts for PAYG (Pay As You Go), super contributions, and factors in other standard deductions.

Precision and Trustworthiness

Because the tool is built on official ATO guidelines, you can trust that the numbers it produces are precise, up-to-date, and reflect accurate income tax calculations.

Easy to Use

No need to do complicated math yourself. Simply input your salary details, and let our payroll calculator Australia handle all the hard work—just like having a personal finance expert by your side.

Confidence in Your Results

With the calculator’s adherence to ATO standards, you can feel confident that the output reflects your true take-home pay Australia accurately.

Usage Of Australian Pay Calculator Based On All Regions

For Sydney & New South Wales (NSW):

For Queensland (QLD):

For Melbourne & Victoria:

For Adelaide & South Australia:

For Canberra:

Everyday Use and Peace of Mind:

Detailed Features of Our Australia Pay Calculator

Now that you’re familiar with how the tool works, let’s explore the specific features and how each of them makes understanding your take-home pay simpler and more accurate.

Calculator Options You Can Adjust

Includes Superannuation

This option ensures that your superannuation contributions are included in the calculation. Superannuation is essentially your retirement savings, which employers in Australia contribute to on your behalf. By toggling this option, you can see how these contributions affect your overall income.

No Private Hospital Cover

If you don’t have private hospital cover, this feature automatically calculates the Medicare Levy Surcharge you may owe. It’s important because if your income is above a certain threshold and you don’t have private health insurance, the government charges an additional levy.

Non-Resident

If you’re a non-resident for tax purposes, selecting this option adjusts your tax calculations. Non-residents pay tax at a higher rate and are not eligible for the tax-free threshold that residents enjoy.

Student Loan

If you have a HELP or HECS student loan, the calculator will include any repayments that are required based on your income. This ensures that your student loan debt is factored into your take-home pay calculation.

Working Holiday Visa

If you’re in Australia on a working holiday visa, this will adjust your tax rate and ensure that the correct tax treatment is applied. Working holiday visa holders have different tax rates than other residents, and this option ensures your calculations reflect that.

No Tax-Free Threshold

For those who do not qualify for the tax-free threshold, whether because of residency status or other factors, this option ensures your salary is calculated with the appropriate tax deducted from the first dollar you earn.

Withhold Tax Offsets

Tax offsets are applied to reduce the amount of tax you owe. If you’re eligible for offsets, this feature ensures they are taken into account, giving you a more accurate net salary and reducing the tax burden.

Summary Breakdown of Your Pay

Gross Income

This is your total income before any deductions. It’s what you earn before tax and other expenses are subtracted. The calculator shows your gross income for different pay periods—weekly, fortnightly, monthly, and annually—so you can get the full picture of your earnings.

Superannuation

The calculator automatically includes superannuation (retirement savings) if you’ve opted to include it. It shows how much of your gross salary is being contributed to your super fund each period.

Total Tax

This includes all taxes deducted from your salary, including income tax, Medicare levy, and any other applicable deductions. This helps you see exactly how much of your earnings are going towards taxes.

Income Tax

This is the amount deducted from your salary based on your income tax bracket. The calculator uses the latest ATO tax rates to ensure this is accurate.

Student Loan

If applicable, the amount deducted for your HELP/HECS repayment is displayed here. The amount is based on your income and ensures you stay on top of your student loan obligations.

Medicare Levy

The Medicare Levy is a standard tax that helps fund the public healthcare system. This is shown separately so you can clearly see what is being deducted for Medicare.

Tax Offsets

This shows any eligible tax offsets you qualify for, which can reduce the overall tax you owe, boosting your net salary.

Take Home Pay

Finally, the calculator shows your net salary, which is your take-home pay after all deductions are accounted for. This is the amount that ends up in your bank account after tax, superannuation, student loans, and any other deductions.

Once you’ve entered all the relevant details, the calculator gives you a comprehensive breakdown of your salary:

Why You Can Trust Pay Calculator Australia Results?

Real-Time ATO Data

All calculations are based on the latest tax information from the Australian Taxation Office (ATO). This ensures that your net salary is calculated with the most up-to-date tax rates and rules, giving you accurate results.

Personalized for Your Needs

With options like including superannuation, adjusting for your visa status, and factoring in tax offsets, the calculator tailors results to your specific situation. You get a precise look at what you’re actually taking home based on your circumstances.

Reliable and Transparent

Our tool doesn’t hide anything. Each deduction is explained in detail, and you can see exactly how each factor influences your take-home pay. You can trust that the numbers you’re seeing are not only accurate but also reflect your actual pay situation.

Key Features & Benefits of Our Australia Pay Calculator

Our Australia Pay Calculator isn’t just another tool—it’s a reliable companion in understanding your finances. Here’s why you can count on it:

Accurate & Up-to-Date:

We pull the latest information straight from the Australian Taxation Office (ATO). This means the tax rates, deductions, and superannuation details used in our calculator are always current, giving you the most accurate results possible. It acts as a trusted income calculator Australia.Lorem ipsu dolor sit amet, consectetur adipiscing elit. Aenean diam dolor, accumsan sed rutrum vel, dapibus et leo.

User-Friendly Interface:

We designed the tool with you in mind. The layout is simple and intuitive, so you can input your salary details with ease. No complex jargon or confusing steps—just straightforward guidance and clear results, making it one of the best salary calculators Australia available.

Versatile Calculations:

Whether you’re paid weekly, monthly, or yearly, our calculator adjusts to fit your needs. It can handle various pay frequencies, making it a comprehensive weekly pay calculator Australia, monthly pay calculator Australia, or yearly salary calculator Australia in one tool.

Data Security:

Your privacy is important. We use secure protocols to ensure that any information you enter stays safe. Our calculator doesn’t store your data, so you can calculate your salary worry-free using a secure net salary calculator Australia.

Trust & Confidence:

By building our calculator on trusted ATO guidelines and industry expertise, we assure you that the numbers you see reflect your true take-home pay. This confidence comes from transparency, adherence to official sources, and providing an authoritative tax calculator Australia.

Step-by-Step Guide to Using the Australia Pay Calculator

I’m here to make sure using our Australia Pay Calculator feels like chatting with a friendly finance expert. Let’s go through each step together, explaining the features in detail so you know exactly how to use the tool confidently.

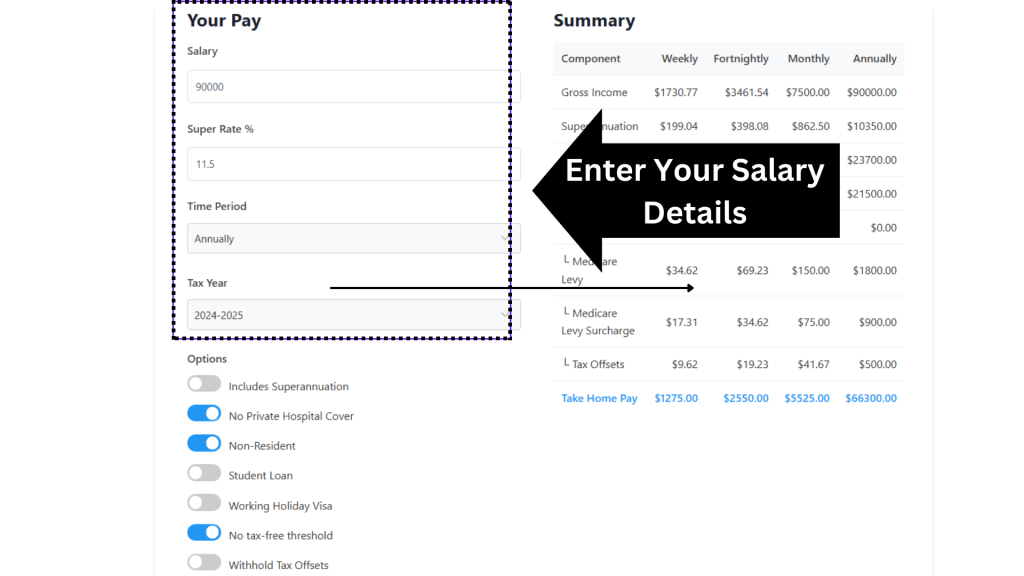

Step 1: Enter Your Salary Details

Imagine we’re sitting down with your payslip. The first thing you’ll do is type in your gross salary—that’s the total amount you earn before anything is taken out. Whether you’re paid weekly, monthly, or yearly, our tool adapts to your schedule.

The interface is clean and straightforward, with clear labels for each field. You won’t have to guess where to put your income; everything is laid out in a simple way, guiding you smoothly through the process.

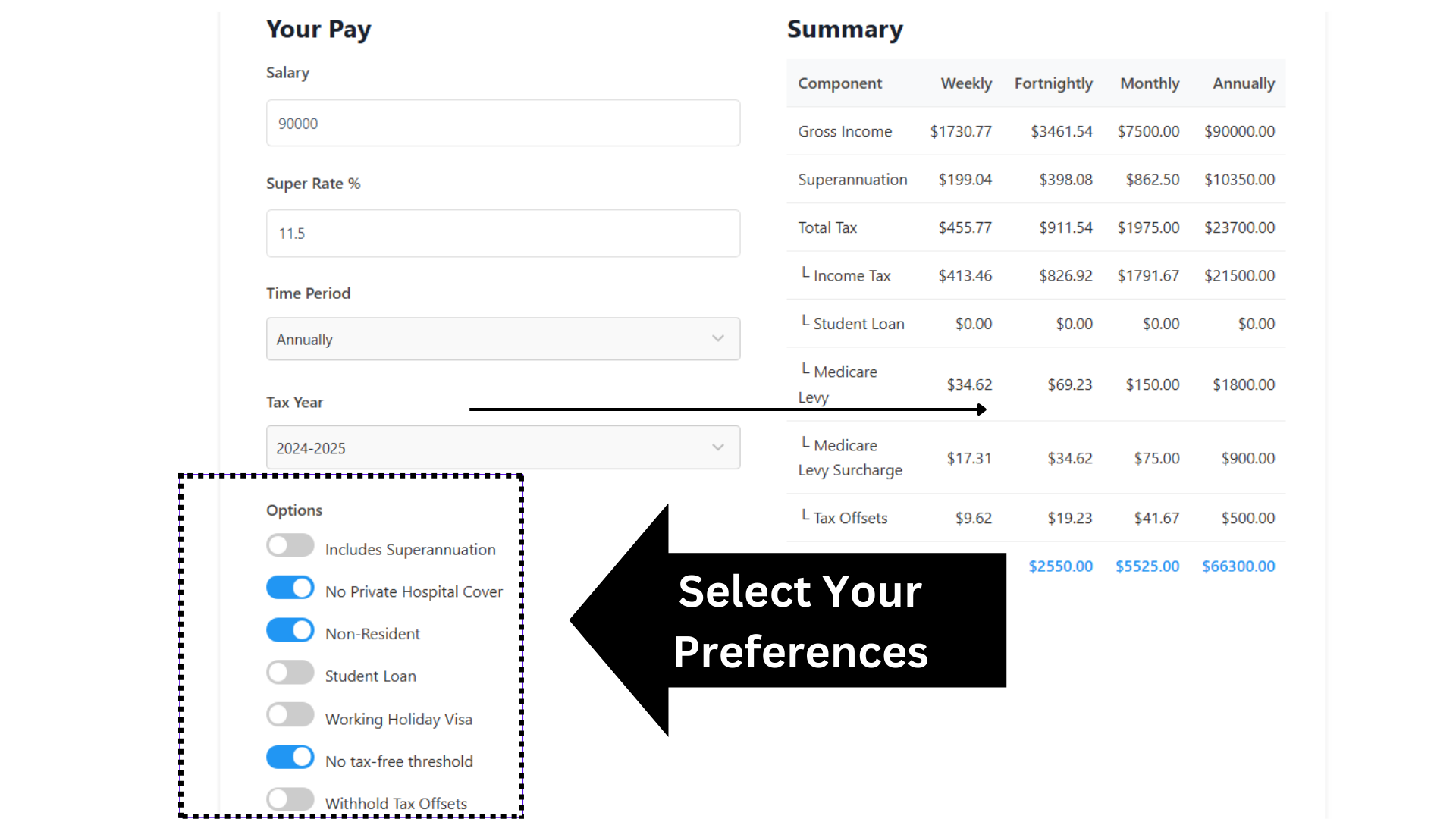

Step 2: Select Your Preferences

Now let’s tailor the calculator to match your situation. This step is like customizing your financial profile:This customization makes the calculator as personal as a conversation with a trusted advisor who asks, “What else should I know about your pay?”

Note: Optimize your gaming performance by identifying and eliminating hardware bottlenecks with advanced PC Bottleneck Calculator.

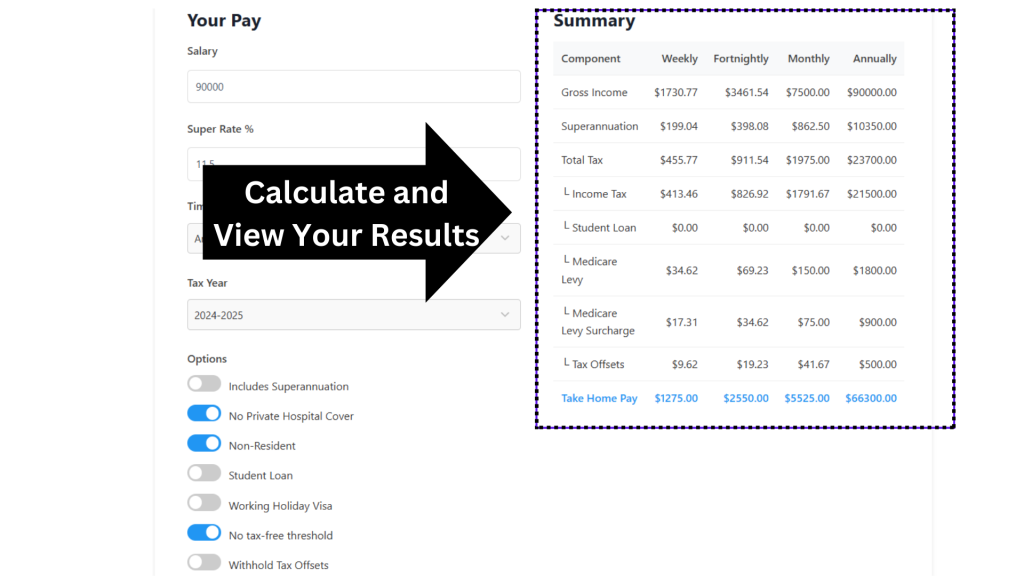

Step 3: Calculate and View Your Results

Once you’ve entered all your details, simply click the “Calculate” button. This is where the magic happens:The calculator uses the latest tax rates and guidelines from the Australian Taxation Office (ATO). It crunches the numbers quickly and accurately.

It breaks down your salary step-by-step:

- Gross Salary: The total you earn before any deductions.

- Taxes and Deductions: A clear list of how much is taken out for taxes, superannuation, and any other deductions you’ve entered.

- Net Salary: The amount that actually ends up in your bank account after everything is deducted.

- Seeing this breakdown is like having a detailed explanation from a finance expert. You can review each part, understand where your money goes, and trust that the calculations are correct because they come straight from official ATO data.

Trusted Accuracy Backed by Australian Authorities

When it comes to understanding your pay, trust is everything. I want you to feel confident that our Australia Pay Calculator is not only accurate but also built on a foundation of expertise and credibility. Here’s how:

Expertise and Authority:

Our tool isn’t just thrown together—it’s crafted by finance professionals who specialize in Australian payroll and taxation. We rely on years of experience and deep knowledge of how taxes work in Australia, so you can trust that every calculation is done right.

Official Data Sources:

We don’t make up our numbers. Every figure and rate used by our calculator comes directly from the Australian Taxation Office (ATO). By adhering strictly to the ATO’s guidelines, we ensure that our tool reflects the most current tax laws and regulations. This dedication to official sources means our calculator provides trustworthy insights into your salary.

Commitment to EEAT Principles:

Expertise: Our content and tool are designed by financial experts who know the ins and outs of Australian tax.

Authoritativeness: We reference the ATO and other reputable sources like Fair Work Australia and industry-standard financial literature, making sure the advice and data you see come from recognized authorities.

Trustworthiness: Security and privacy are paramount. We use secure connections and never store your personal salary data. This respects your privacy and builds your trust in our service.

Security and Data Privacy:

Your privacy matters. We’ve set up our calculator with top-notch security measures, so whatever information you enter stays private. We follow Australian data protection standards closely, giving you peace of mind as you use our tool.

By combining expert knowledge, official data, and a strong commitment to your security, our Australia Pay Calculator stands as a reliable source for your financial inquiries. It’s like having a trusted financial advisor by your side, available 24/7 and ready to calculate your net salary in seconds.

Frequently Asked Questions

I know you might have some questions about using our Australia Pay Calculator, and that’s totally okay. I’ve gathered answers to the most common queries to make sure you feel informed and secure about using this tool. Each answer draws on authoritative sources and simple explanations.

Calculate Your Net Salary Now

I hope you’ve enjoyed learning about how our Australia Pay Calculator can simplify your financial life. Now, let’s take the next step together. Whether you’re curious about a new job offer, planning a budget, or just want clarity on your paycheck, our tool is here for you.

Why Use the Australia Pay Calculator Right Now?

Govt Notices Latest

The latest updates from the Australian government regarding income tax and related measures for the 2024-25 financial year include several key changes aimed at easing cost-of-living pressures and adjusting tax scales to be more equitable:

Personal Income Tax Changes:

The government has enacted tax cuts effective from 1 July 2024, designed to alleviate cost-of-living pressures. These include reducing the tax rate for income between $18,201 and $45,000 from 19% to 16% and adjusting other income thresholds and rates upward to benefit middle-income earners.

Medicare Levy Adjustments:

The low-income thresholds for the Medicare levy have been increased, ensuring that low-income individuals and families are exempt from the levy or pay it at a reduced rate. This change is intended to help more than one million low-income Australians avoid additional tax burdens.

Tax Compliance and Enforcement:

The government is extending its Personal Income Tax Compliance Program, aiming to enhance compliance activities that prevent and correct tax reporting errors. This extension reflects a focus on maintaining integrity within the tax system, especially concerning deductions related to short-term rental properties.